The U.S. Playbook

How to Hit the Ground Running With U.S. Expansion

Frontline Library » The US Playbook » Hit the Ground Running

CONTENTS

- Introduction

- When to Expand

- Where to Land

- Hit the Ground Running

- Who to Hire & Relocate

- How to Hire Top Talent

- Managing Across Borders

- Summary

Founders should spend a lot of time in the US before officially expanding. In our experience, that looks like four to six trips a year, up to three months at a time, to familiarise yourself with the geography, culture, and local market. This frequency is regular enough to keep a drumbeat with in-person customer meetings, not enough to fall foul of visa limits and tax rules, and a good halfway house between the new market and HQ.

Workvivo

The research trips will allow you to build real relationships with potential investors, partners, and customers, and vet various service providers before signing expensive contracts.

But with so many people to meet and places to explore, it can be easy to get distracted. Here are our tips for making the best use of your time.

Plan your trips ahead to make the time and financial investment worth it

Build a list of people you’d like to meet and leverage your network to set up meetings. Before you even get on that plane, qualify those leads radically.

Frontline Seed

Sign up for a handful of events recommended to you by professional contacts. There is a lot of noise in startup ecosystems like SF and NYC, and it’s easy to waste all of your nights at meetups that provide little-to-no value. Vet out events and conferences to optimise your time there.

Pointy

Front-load your meetings

Have most of your meetings and events planned in the first part of your trip and leave the rest of your time fairly flexible. This will allow room for rescheduled meetings (which will inevitably happen), referrals from previous meetings, serendipity, etc.

Be smart about where and when you go

Some hubs may empty out during summer or winter months, and for public holidays such as Thanksgiving and Labor Day, so ask around before you go about the best times of year to visit. As we discussed previously, be mindful of time zones and how that will impact your workflows at HQ.

Staying on the East Coast with a smaller time zone difference also meant I could keep working with my team in Spain for 6 hours a day, and devote another 6 hours to local meetings and events. Overall, January was a bad time to go – the weather was bad and lots of people had left the city, so there weren’t many events until March.”

Tucuvi

Know why you are going, and come prepared

There should be a concrete goal to be achieved at the end of this trip. Is it to secure US investment interest from at least one VC? Is it to close a deal with a corporate partner? Have clarity on why exactly you are taking a pause from your day-to-day operations to embark on this trip. Make sure you have the necessary pitch decks and proposals to set you up for this success.

We’d be selling to hospitals, and one of the most tangible takeaways from the trip was understanding the importance of the Head of Patient Experience – this role doesn’t exist in Europe but acts as a pivotal decision maker in the States, and would impact our whole route to market there.”

Tucuvi

Make sure you stay on the right side of U.S. customs and Border protection

As part of the Visa Waiver Programme, citizens from most European countries can use an ESTA (Electronic System for Travel Authorization) to conduct research trips in the US for up to 90 days at a time.

These cost around $20 and take a couple of days to be issued, but don’t leave it to the last minute to apply — in some cases they can take over a week to come through.

Be prepared to answer questions about your stay when you arrive in the US. Ultimately, Customs and Border Protection wants to understand that the activities in which you participate during your visit are acceptable under the Visa Waive Programme and do not require work authorisation, i.e. you will not be coming to the US to stay and engage in productive work for a US company.

You always need to have a return flight booked and accommodation sorted, as well as the paperwork evidence to prove that. The slightest mistake can prevent you from entering the country, and customs can ban you from entering for any length of time if you are found to be abusing the Visa Waiver Programme.

Top tips for Europeans on U.S. business culture

The fact that Americans speak English makes it easy to assume that there aren’t too many cultural differences between the continents. But there are lots of cultural quirks that can be surprising and difficult to adjust to – particularly when it comes to hiring and selling to Americans. Here are some tips for navigating the US market.

Be deliberate in who you meet with

It is generally easier to get introductions to people in the US than in Europe (one founder even said “10x easier”).

However, just because you are getting meetings does not mean that progress is being made. Make sure you are targeting decision makers and have as clear an understanding of the buying process before the meeting as possible.

Tucuvi

Understand local meeting etiquette and don’t expect too many pleasantries

Do not waste time and be straightforward in meetings. Set objectives at the start of the meeting, and have a concise and confident pitch, as most meetings will not exceed 30 minutes.

Some Americans can be very frank – we even heard “no shame” from one founder. If they are not interested, they will tell you upfront and may even cut the meeting short. You should be especially mindful of this when talking to investors, who have little tolerance for the abstract or anything “fluffy.”

Local etiquette may differ depending on the region of the country — the US is huge and sometimes regional differences can be akin to travelling between different European countries.

Do not undersell yourself

Europeans tend to come off as reserved, while Americans will have no problem tooting their own horns. This is essential to be aware of on sales calls and when pitching to investors. You will often need to paint a picture of the big, $10b vision. Your existing investors can help you perfect your pitch.

Frontline Seed

Localise all of your materials, but don’t lose your personal identity

Make sure that all of your marketing, case studies, and website content has American spellings (“personalize,” not “personalise” and “color,” not “colour”) and that the pricing is in dollars. Do this early (using your European resources before you have boots on the ground, if you can), and if you don’t have the inhouse marketing resource to do so, hire a local freelancer on Upwork to localise your materials – they’ll spot nuances you can’t.

Most importantly, make sure you have US reference customers as early as possible– many founders found out the hard way that European traction and proof points aren’t taken seriously.

However, you don’t need to completely “Americanise” yourself – your background or accent can be the differentiator that causes you to stick in customers’ or investors’ minds.

Pointy

Bring on professional service providers as early as possible

When it comes to legal, tax and compliance, the US is not a country where you can “do it yourself”, not least because there are 50 different states that each have their own rules.

You need to have a qualified immigration lawyer and US corporate lawyer early on, as well as a tax consultant who knows the intricacies of both the US systems and those in your home country. They can help you get your company incorporated in the States, complete a Delaware flip (more on that in a bit) if necessary, advise on transfer pricing and royalties, and generally help with getting your business set up in a cost-efficient manner from the outset.

Frontline recommended attorneys

- Dentons

- Goodwin

- Haynes Boone

- Latham & Watkins

- Mintz

- Wilson Sonsini

Want to see all of our recommended suppliers for

U.S. expansion?

Fill in the form and we’ll email you the full list, from finance and legal to HR and consulting.

With that said, there are *many* ways to get things wrong when navigating the US tax system, with a lot of intricacies and nuances to the Federal, State and local tax systems. And these may have very pricey fines or late filing fees attached to them. For example, in the UK you might get a £100 slap on the wrist for a tax return submitted a few days late — in the US you can be hit with a $25k fine for submitting a minute late.

USTAXFS

Each state has its own criteria for determining what constitutes a ‘nexus’ (connection) with that state. If you have nexus, there will be tax and finance implications — do not hire anyone or “trade” in any particular state until you understand the liabilities of having nexus.

Find local advisors

Take the time to meet with individuals you would want as advisors – it should be both a personality and professional fit. The ultimate “dream” advisor can provide you with useful high-level advice, make introductions to people you wouldn’t normally have access to, and industry prestige carried by their name. Consider attending sector-specific conferences, and consult your existing investor and founder networks, and maybe your US lawyers, to source intros to potential advisors.

Frontline Seed

Incorporating your business in the US

You will need to incorporate your business in the US in order to do business there. Most companies will be best suited to become a business corporation (Inc., which is deemed as a C-corp for US tax purposes). You can incorporate in any of the 50 states but Delaware has the most straightforward process and business-friendly environment, and is also relatively inexpensive.

According to Wilson Sonsini, Delaware is the state of incorporation for 68% of the Fortune 500, 65% of the S&P 500, and approximately 79% of all US IPOs in 2022.

Incorporating in Delaware does not mean that you have to have a physical presence in the State, you just need a registered agent with a physical address there. Those that do not conduct business in Delaware do not have to pay state corporate income tax. Instead, they pay an annual franchise tax, which is typically around $300.

Do not delay incorporation – do it sooner rather than later to prevent the headache of having to do it when your company has gained momentum or is raising a round.

Once the US subsidiary has been established, you will need to appoint a registered agent and qualify to do business in each state where you are “doing business.” This is generally every state where you have an office or where you have employees regularly performing services. Online services can take care of part of the process for you.

Do I need to do a Delaware flip?

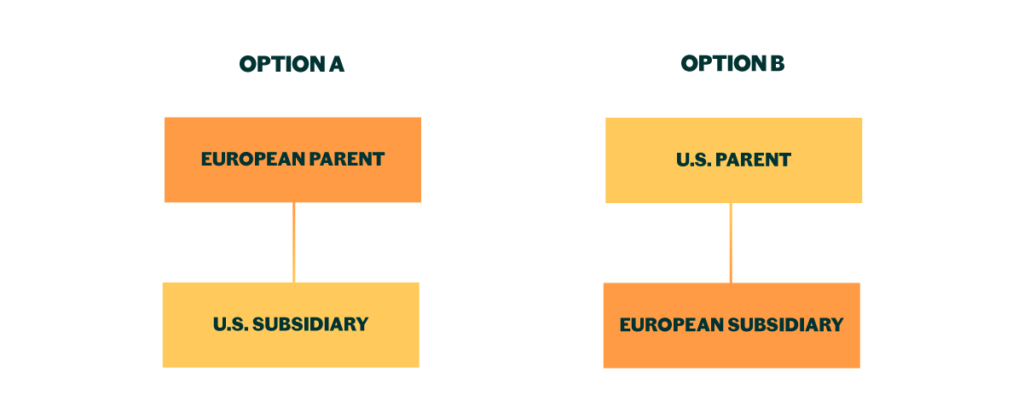

This is one of the most common questions we get when supporting a company’s US expansion. A Delaware flip is the process of ‘flipping’ your parent company from your existing European one to a Delaware corporation. That means that all your existing shareholders will become shareholders of the American entity, and your European business will change to a subsidiary.

Unfortunately, the answer is incredibly nuanced depending on your current stage, future investment plans, and the laws in your HQ country. You should speak to your lawyer, tax advisor, and existing investors about the decision.

If you do decide to flip, it’s likely to be cheaper and easier to do so sooner rather than later while there are fewer stakeholders and complexities in the business. But you have to weigh this with the fact that the later stage a company is, the less important a Delaware topco becomes.

You must consult a tax advisor when considering a Delaware flip, as there may be tax implications for both the company and your existing shareholders, and it may also impact government grants you have received in your home country.

It is important to draw a distinction here between UK-incorporated companies and those across the rest of Europe. In general, a UK-incorporated company past Series A, does not need to complete a Delaware flip to become more appealing to US-based investors.

According to Wilson Sonsini, only 25% of UK companies actually flip at that point, and past Series B, this drops to zero. By contrast, over 90% of continental European companies will need to flip if they want to close a US investor, whatever stage of their lifecycle. Sadly, the individual European legal systems are often very bureaucratic and complicated and not worth the time and cost to a US investor.

So whilst founders may initially see a Delaware flip as an administrative undertaking for the benefit of US-centric investors, we find that many are happy they did so, as they can operate with more efficiency and flexibility over time. With that said, initial and ongoing costs can run high and you will need to consult with expert advisors to fully understand the implications for your company."

Frontline Seed

Getting your U.S. visas in order

Once you’ve decided which of your team you’ll be relocating to the States (more on that later), you’ll need to apply for their Visa, and these must be 100% sorted in advance of your move. Getting this wrong could backfire massively for the business and for you personally. Be aware that the US immigration system is highly bureaucratic and discretionary — you should give yourself 6–12 months for a successful visa application and consult a qualified US immigration lawyer as early as possible.

Below are the different visas you may consider and the associated costs (for full information visit the U.S. Citizenship and Immigration Services site)

Although the US immigration system may not be as streamlined as desired, applications are usually successful if correctly managed. It is important for counsel to set realistic expectations regarding challenges, timelines, and potential delays.”

Fragomen

Immigrant vs non-immigrant visas

For US immigration purposes, a non-immigrant visa is a temporary visa (though it may grant work authorisation for an extended period, as much as three years, and be renewable thereafter), whereas an immigrant visa, commonly referred to as a “green card”, grants permanent residence status. You should expect to pursue the non-immigrant path initially as this is generally the fastest way to obtain work authorisation in the United States. If you do want an employee to stay for a longer period, you can often pursue a green card whilst already working in the US on the non-immigrant visa.

L1 intracompany Transfer

For individuals that have worked for the company for at least 12 months in an executive, or managerial position, or have specialised knowledge (unique, advanced knowledge of the organisation’s processes, procedures, tech, product and services etc.)

E1/E2 Treaty Trader/Treaty Investor

For citizens of countries with which the United States maintains treaties of commerce and navigation. Individuals must be coming to the US to direct the operations of an enterprise in which the applicant has invested a substantial amount of capital, or to work for as an executive, supervisor, or skilled employee. The company must first register with the US embassy in the country of ownership (determined by the nationality of the business owners), establish the substantiality of the investment and prove the company is active.

O-1 Individuals of Extraordinary Ability

For individuals with sustained and international prominence, in the top percent of their industry. There are a series of criteria here (e.g. employed in a critical industry capacity, original contributions to the industry, high remuneration, awards, publications), generally at least three of which should be achieved. This is a high bar but it does work for C-Suite and other senior folks.

H-1B Specialty Occupations

Costs associated with U.S. Visas

There are a number of different fees associated with a visa application with a fairly broad range, depending on various factors:

Legal fees will run anywhere from $3,500–$10,000 for the initial petition, based on the type of visa and corresponding work required to establish company and individual qualifications. These will often be billed transactionally, rather than hourly. In certain instances, the costs will diminish as the company sponsors further petitions, as the government can rely on previous evidence that the company has legitimate US operations.

Filing fees to the U.S. Citizenship and Immigration Services can also range in value, as they are visa-specific and subject to change, currently between approximately $2,300 and $5,000.

Visa stamping fees are based on the Department of State’s “reciprocity table”, and vary based on the visa type and applicant’s country of birth. Generally, these are much lower than the filing fees, and are in the hundreds, not thousands.

The Practicalities of Moving to the U.S.

When it comes to actually moving to the US, you’ll have to get a lot of documents and processes set up early on. You’ll need a bank account, social security number (SSN), place to rent, and mobile phone number once you land – and there’s a certain art to getting the timing and order of these things right, as some of them are dependent on others. Here’s a cheat sheet to getting all of your affairs in order once you’re on the ground.

1. Letter of Introduction

You will need a letter of introduction from the company that confirms (a) your address (or wherever you’re staying when you first arrive), (b) your salary (c) confirmation of the date of your move and (d) the visa you’re under. Make sure the letter is headed with the company name, address, contact email.

2. I-94

The I-94 form tracks the arrival and departure of non-immigrant visa holders. You can access the form once you’ve landed, and will need it to obtain your SSN and to get set up on US payroll.

3. Social Security Number

Your Social Security Number (SSN) is a nine digit code that is used for various forms of identity verification. Upon application, your SSN card will take 8–14 days to arrive, and is required for a lot of service, so submit your application as soon as possible after you’ve landed. You’ll need to apply in person and bring along a completed SS-5 form, two forms of ID, your passport with visa, and your I-94 form.

4. Mobile Number

Your options here will depend on your existing contract — if you already have good data coverage on your European contract then you may just want to get a prepaid plan in order to get a US number. It will be quicker to walk into a store to set this up.

5. Bank Account

To open an account you need to book an appointment at any branch and visit in person. We recommend using Chase. The process here will be fairly straightforward but it will take around an hour, and the associated debit card will arrive in the post. Remember to bring proof of address (your letter of introduction is acceptable), two forms of ID, your mobile number, and your SSN.

6. Credit Card

Where to Land

Who to Hire & Relocate