...And why most VCs get it wrong...

VCs always say that they want an entrepreneur who executes rapidly, moves fast and gets things done quickly. Why then are the majority of VCs incredibly slow when completing their own due diligence and making their investments? The average time for most VCs in Europe from first meeting to a term sheet is not measured in days or weeks, but usually months!

Historically VCs were able to move at this very slow speed because they had all the power in the entrepreneur/investor relationship. There were very few investors who controlled access to capital and entrepreneurs were therefore forced to move at the pace of the VC when fundraising. Well, the European ecosystem has evolved significantly since we started Frontline seven years ago and recently, we have seen this dynamic flipped on its head.

In January Dan Primack tweeted a stat from Josh Kopelman in First Round capital. It speaks wonders of the need to move fast in venture and how things have changed:

“Josh Kopelman of First Round Capital: we can look at every company we’ve ever funded, and learned that the time from first email/contact to term sheet has shrunk from 90 days in 2004 to just 9 today.” – Dan Primack (@danprimack) January 29, 2020

Just last week, Nikhil Basu Trivedi wrote an article discussing the rise of Solo Capitalists in the venture industry. He specifically states their ability to move faster than normal VCs on deals as one of the key reasons for their rise.

At Frontline we have seen similar trends in Europe with rounds closing faster and faster. The last decade has seen the European venture landscape grow at a neck-breaking pace.

Over 60% of the funds in Europe (that we are aware of), were not in existence when we started seven years ago (and I still feel like we are relatively new on the block!). Not only that, but there has also been a 70%+ increase in capital coming in from the US, and 135%+ increase coming from China into Europe in 2019. This has changed the dynamic. The best entrepreneurs no longer need to wait for the slower VCs - they will get access to the capital they require, quickly.

Why have we not seen VCs change and adapt to moving faster in Europe?

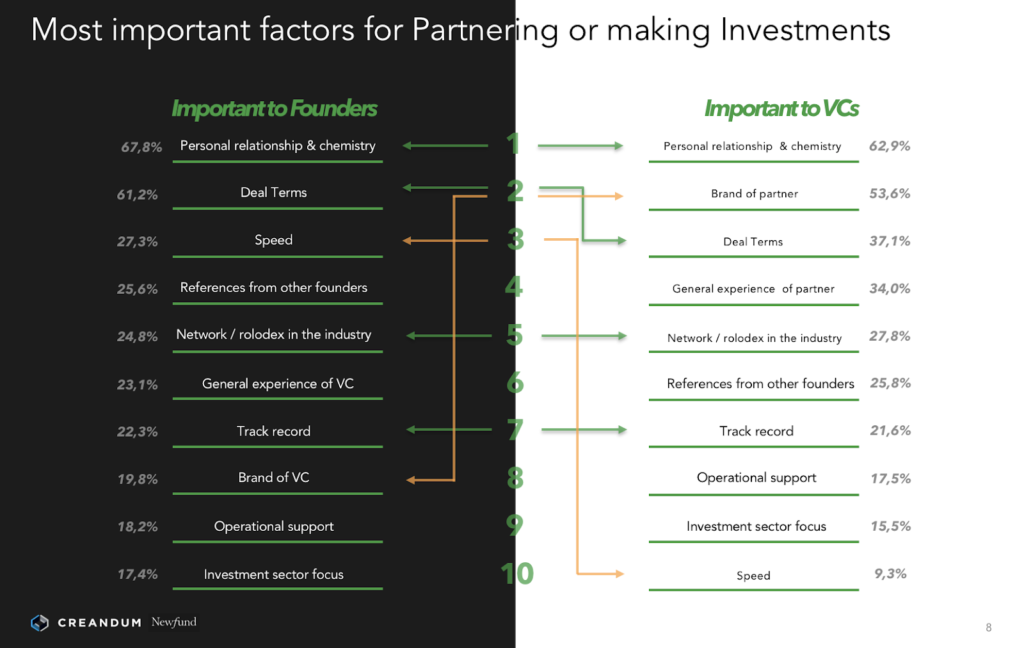

It seems most are not even aware that it is a problem. In a study published in Hackermoon by Carl Fritjofsson (Creandum), Henri Deshays (NewFund), and Owen Reynolds (Expon Capital), hundreds of VCs and Entrepreneurs were asked to rank what were the ten most important factors entrepreneurs wanted when choosing an investor. Entrepreneurs listed SPEED as their 3rd most important factor. VCs, on the other hand, listed it as the 10th most important factor - Speed barely made it onto the VC’s list.

We see a hint at why this disparity exists in the same study. Entrepreneurs ranked VC Brand a lowly 7/10, whereas VCs believe their brand to be a significant competitive edge, ranking it as the 2nd most important reason for “being chosen”.

This speaks volumes to the egos in VC. In reality, we need to realize that we are service providers who are there to support the entrepreneurs - not the other way around. Investors need to adjust to the pace of our Founders - they should not need to adjust to us.

Speed as an indicator of success

In a previous analysis, I wrote about what I had learned when looking through all the data of the companies I have said NO to since I became an investor (at the time, 6 years worth of data). While there were a number of important learnings from it, one really stood out to me. The companies that I said no to because I didn’t have time to complete due diligence (i.e. I was not fast enough) had performed substantially better than my portfolio.

To put that in context, if I had never done a single piece of due diligence and only had invested in the companies whose rounds were closing fast, then my new hypothetical fast-moving portfolio would have raised more capital than my current one has. This was an eye-opener, both for myself and the broader Frontline team.

To be fair to VCs, it is hard to move as fast as the best entrepreneurs. They are the best entrepreneurs for a reason. A VC usually only has from a few days to two weeks to do due diligence on the product, market, metrics and team for these fast-moving companies. The issue is that we have seen a number of VCs take shortcuts and try to solve this problem in two very worrying ways.

a) Taking shots blindfolded

This is where funds hear a company has a termsheet and just immediately makes an offer assuming that the other fund has done the necessary due diligence. This incredibly risky behaviour is purely driven by FOMO. As well as service providers to our entrepreneurs, VCs also have serious fiduciary duties to our LPs. We are managing the capital of millions of pensioners, university/hospital endowments, banks, and governments. It is our duty to ensure that we are doing proper due diligence on the companies we invest in. If anyone wants to see a great example of investors rushing to invest without proper due diligence just read any book, blog, podcast or article on Theranos. 😳

b) Quick, meaningless termsheet

The second way we have seen funds deal with the speed “issue” is by quickly issuing a termsheet before due diligence. To the entrepreneur, this might look like a fast-moving fund, but behind the scenes, this is about locking entrepreneurs into exclusivity - while the VC team then races to catch up on lost DD time. The “hiccup” here is that oftentimes, and as expected, due diligence turns up problems and a deal gets shutdown. This means that the VC has just wasted anywhere from 30–60 days of the entrepreneurs’ time, only to have them start from scratch and look for another investor.

While both methods outlined above allow VCs to compete for fast-moving deals, we felt that the first did a disservice to our LPs and the second to entrepreneurs - the two core groups we are supposed to serve.

Back to First Principles

So we decided to bring the problem back to first principles. We spoke to many entrepreneurs to find out how long would they wait for a new investor to finish their due diligence if they already had a term sheet from another investor. The maximum number that kept coming up was one week. So we concluded that we needed to design a process that could be consistently completed within a week. We then reviewed our due diligence, investment committee, legal and all other processes, to identify ways in which we could safely and swiftly, speed up our operations.

While making quite a number of smaller changes (which I won’t detail here), the major change was to our internal due diligence process. We called our new process Swarm. (Apologies for the super cheesy name - but hey, we gave ourselves a grand total of 5 mins to come up with it; in the name of speed)

As happens often with conceptual processes; Swarm sounds very simple on paper, but is quite hard to implement in the real world. As soon as a member of our investment team sees a deal that a) they believe to be a great fit for us and b) is moving faster than our usual due diligence processes would allow, they have the ability to call a Swarm. They send an email to the whole team, with all relevant info, core questions and key people we want to speak to.

Once a swarm is activated, all other members of the investment team cancel everything that is not compulsory in their calendars over the next week and we all work towards getting as much information, data points, conversations completed in that time. What normally takes a single investor on our team several weeks, with 4–5 people working on it, gets done in a few days. This ensures that we can move as fast or faster than others - without sacrificing the quality of our due diligence.

Getting the team to coordinate last minute at a rapid pace - effectively and cancelling a lot of other calendar appointments is not easy. It requires a lot of trust, coordination and concentration across the team. Since we launched this process we’ve done almost a dozen swarms. Not all have led us to offers but many have allowed us the privilege of winning a deal we might not otherwise have seen. I can proudly say that since switching to this process we have not lost one deal due to speed.

VCs need to aspire to move as fast as the best entrepreneurs if they want to work with the best of them. At Frontline we will always look for ways to be able to run alongside entrepreneurs at their pace and not make them slow down.