It’s not that going in cold to a venture capital fund is bad, it’s that most cold emails are poorly put together in the first place.

Whether it’s the info@email, a form submission, or cold emailing investors directly, there are usually a number of routes to get in touch with investors without needing a warm intro or mutual connection. However, if you want good response rates from your cold email outreach, then you’ll have to do some groundwork, and follow three key tenets.

1. Investors (People) are busy

Investors spend a huge portion of their day trawling through their inbox (that’s why VCs have so much love for companies like Superhuman). Between incoming pitch decks, portfolio companies, general admin and meeting coordination, there’s a lot going on. As someone sending a cold email into this system, you have to remember you’re dropping into that maelstrom – incognito.

2. Investors (people) have limited free attention

3. Investors (people) like to see things that specifically interest them

How to prep an effective cold email pitch

- What exactly does your company do?

- What is the single sentence that best describes your company? What stage of investment are you at and what stage of the fundraising process are you in (e.g. do you already have some interest, or a lead investor in place)?

- What country is your startup operating in now – and where do you plan to be physically located in the future?

- What sector are you in, and is there a technological or market trend you’re leveraging to build your business?

- Based on the answers to these questions you can start figuring out which VC firms will be interested in your company, based on their investment theses.

Which VCs to target your cold email to

Junior investors (depending on the fund) are super thirsty for deal flow. They also have a surprising amount of knowledge when it comes to shepherding deals through the labyrinthine process that is a venture fund partnership’s decision-making apparatus.

So, first figure out which is the right investor in a fund for you to target. Do not email multiple people; it creates a weird dynamic in a fund where people wait for the other person to run with it. Find the person in the fund you think is most relevant and accessible to you. If you go for a Partner and they don’t reply, follow-up with their Associate. It’s more likely that the partner is busy rather than ignoring you because they are uninterested.

You can just email [email protected] to throw your hat into the ring. That said, many VC investors don’t read their cold email (their loss) – so your best bet is to examine your target list of individuals and have a hunt around for their direct email (their website and personal Linkedin / Twitter accounts are a good place to start). If that fails, take a stab at guessing it. There is a strong chance it’s one of the below:

Once you’ve completed all of the above, start drafting your email. This isn’t a manuscript to spend hours on. It’s a quick, simple message. There are, of course, some basic dos and don’ts.

What to include in your cold email pitch to investors

- A single simple paragraph explaining what you do and why you’re relevant to the particular investor (some small personal details – although don’t go too heavy or you run the risk of coming across as creepy)

- A maximum of five bullet points on the most interesting aspects or achievements unique to your business and your product / service.

- Hyperlink throughout (if you’ve relevant social proof on your LinkedIn, website, press, etc.) and attach a single compelling PNG (so it’s easily visible in browser preview). Graphs that go up and to the right are always good!

- Craft a clear ask: typically that is a call or meeting (with your calendly included for ease). The first email is NOT about getting their investment – it’s about getting their interest.

- Attach your pitch deck in the initial outreach

What not to do when cold emailing investors

- Waste words on unnecessary preamble (they’re VCs – of course they had a lovely summer).

- Contact investors who don’t invest in your sector, or otherwise aren’t a good fit

- Use generic statements like “we’re working hard to…”

- Message people on LinkedIn (it works, but it sucks)

- Attach a pitch deck or business plan with 30+ slides

How to follow-up on a cold email pitch to investors

Once you’ve sent the first email, rinse and repeat for your next VC target – successful startups have a 30/1 first-meeting-to-term-sheet ratio, so you’ll need a stacked funnel of investors to have a high likelihood of raising.

If you don’t hear back within a week, then you should absolutely send a follow-up email. Sometimes emails get missed or sent to spam filters, but most good investors will give you some sort of response. Your goal is to get them to set up a time to speak.

The best example of an effective cold email to investors

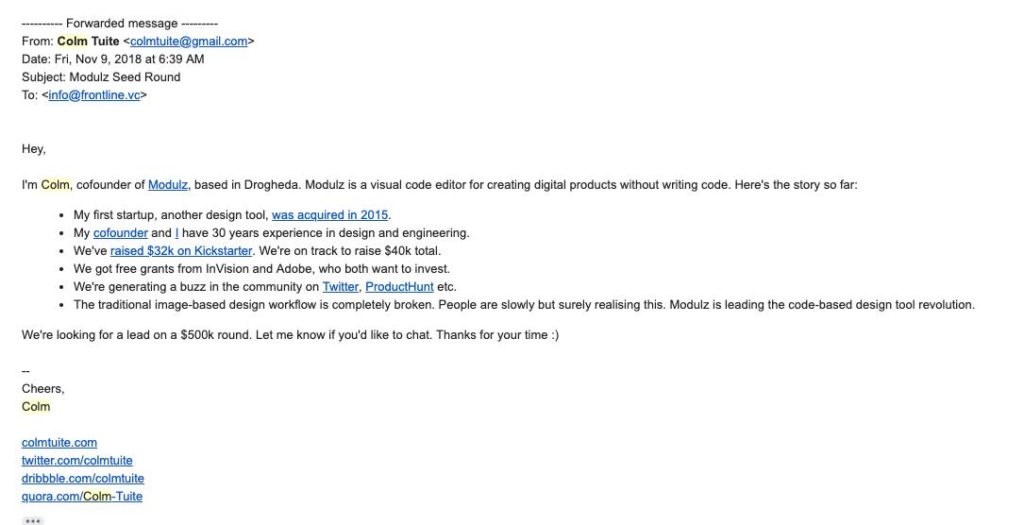

Frontline’s investment into digital design software, Modulz, came about from a cold email. Founder Colm Tuite’s original email is pretty much as great an effort as you can find.

Sliding on into that inbox

This email resulted in us leading a $1m+ pre-seed round into the company. As far as cold emails go, it is clear, intriguing and allows me to easily do some additional research and get bought into the company, without having to actually speak to the founder.

It’s made even better by the fact that, in a subsequent email exchange, the founder mentioned he was also chatting to two other competitive seed funds, one of whom we had recently lost out to on investing in a company we really liked. FOMO is real folks – it’s on you to harness it wisely.

By the time Colm and I actually spoke, I was already very excited about the company.

Cold outreach isn’t easy, and the hit rates will definitely be lower than via warm introductions. But if there’s one thing I’ve learned from reading thousands of cold emails, it’s that the reason most fail isn’t because they’re cold, it’s because they are just plain bad. Put some effort into it, I guarantee it’ll pay dividends.

P.S. Much of the above can be modified for cold emailing anyone – don’t just try it with VCs! New customers, potential hires and great partners can all be sourced through a well written email sent to the right target audience at the right time.

If you’re raising funds for an early stage b2b software company, hit us up ice cold.