In 2016 I was invited to speak at a conference about how Frontline derives insight and changes our investment strategy based on the data we track during our deal flow process.

At the end of my talk, someone in the audience asked if Frontline tracked founder gender in that data and if so, what proportion of female-founded companies did we see?

I acknowledged that we didn’t measure it at the time but I assumed it was around 12–15%. While it satisfied the question-asker, I was uncomfortable with the fact that my answer was little more than a guesstimate so I went back through three months of deal flow data and analysed for gender in all of the deals we saw.

Unfortunately, the data was not at all what I expected. At the time, we had roughly 6% female-founded companies in our deal flow process and only 5% of our portfolio had a female founder (I was guestimating at least double that amount on the panel!)

Initially, while we thought a 6% figure was very low, we also knew that the percentage of female founders in our portfolio was the same as in our dealflow process. So we felt the 6% demonstrated an overall market vs a specific Frontline problem (i.e. not enough women were starting companies in the market or were targeting venture capital as the source of funding).

But, one of the core values at Frontline is ‘Right Over Easy’ and as we discussed this topic further, we realised that blaming the market was the easy answer and not necessarily the right answer. So, we decided to change aspects of how our we sourced our potential investments, how we were branded and our external and internal processes to try to improve the number of female-founded companies in our pipeline – before we easily called it a market problem.

Initiatives for increasing gender diversity in VC

The first thing we started to do was track gender data across our deal flow. That allowed us to track and monitor how effective (or ineffective) different initiatives were.

Over the following years, we tried a number of different initiatives to increase the number of female-founded companies in our deal flow and portfolio.

This is not the full list of things but to give you an idea:

- Relationship building with angels and VCs who invested more often in female founders

- Attending many different female-founder focused accelerators

- Creating an internal diversity and inclusion strategy

- Executing an external PR and Comms strategy

- Specific event targeting

- Focus groups when doing our rebranding

- Supporting female-focused networks/communities

- Review of internal due diligence and investment committee process

- Co-creation of a diversity and inclusion course for VCs

- Sponsorship of female-entrepreneur focused incubator

- Changing internal HR policies

- Open sourcing a maternity policy for VC

- Hosted and attended many open office hours

- All Partners participating in unconscious bias training

…and many others.

Frontline was one of the first funds globally to begin tracking for gender back in 2016. We made it compulsory for all team members to track perceived founder gender in any deal they entered into our internal system.

That has created a very unique data set based on thousands of companies over five years. So I wanted this post to focus on this data and what we see across it.

I recently sat down to look at the progress since 2016 and I finally felt that we have enough data to share and start to see patterns. I’ve written a brief analysis below and separated our findings by Year, Industry, Geography, Source, Frontline Internal Pipeline, and Rejection Reason.

The impact of diversity initiatives on dealflow

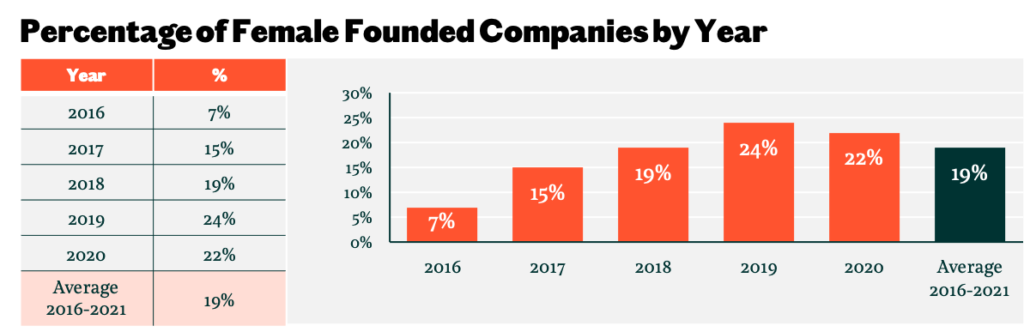

As you can see from this chart, a few months after kicking off a series of gender-focused initiatives, we began to see reassuring results.

Over time, we figured out what initiatives worked (and didn’t). This resulted in a continued increase in gender diversity from 2016–2019.

This past year we did, unfortunately, see a slight drop in percentages. We don’t know for sure what has caused this but believe that this decrease is either a result of lockdown restrictions that shut down many of the female-focused events/initiatives we typically engage in, and/or possibly related to broader implications on female participation in entrepreneurship and the workforce due to Covid-19.

There have already been many reports showing that women have been significantly more affected in the job market, and have seen much higher declines in startup investment than their male counterparts since the start of the pandemic. Regardless, it is our responsibility to curb this decline and we will continue to push for progress.

Over the measured five year period, 18% of Frontline’s portfolio investments were female-founded companies and the average across the whole dealflow process was 19%. I’ve heard many investors place the “blame’ on pipeline for not investing in more female-founded companies. In reality, perhaps they should be doing more to improve their pipeline.

Assuming you have an unbiased process, then increasing the % in your pipeline should also increase the number in your portfolio — as we have seen.

Blaming pipeline as the problem is the easy answer. It is not the right answer!

Almost all of our initiatives over this first five year period have been concentrated in the UK and Ireland.

Once we saw certain initiatives have a deeper impact we began expanding them to Germany and France. So far we have not launched any gender or diversity initiatives in other parts of Europe, nor the US.

The data clearly reflects this where we have spent the most time and resources. Over time we hope to expand many of these initiatives to other geographies.

Frontline divides industry into many different self-defined categories that evolve over time as new areas become more or less important.

In the list above, I’ve highlighted just the industries where we had enough meaningful data points to draw a fair conclusion on what we are seeing from the market. I’ve divided the table into two for ease of reading; the left-hand-side includes all industries where we have seen above-average Female-Founded companies (e.g. RegTech, Health/BioTech, FashionTech, EdTech) and the right-hand-side lists industries where we have seen less than average female-founded companies. (e.g. Insurance technology, VR/AR, Gaming etc)

Frontline is a B2B focused software fund and the majority of deals we saw in Fashiontech, Edtech, Consumer, eCommerce, Healthtech and Biotech (six of the top seven areas for female-led companies according to the data), are not actually within the scope of our target investing areas. To put this into perspective, over 30% of the total female-founded companies in our deal flow pipeline were not even in our investment scope (vs only 13% for male founded companies).

It is a larger question that I don’t have an answer to, but there does seem to be a substantially lower representation of female founders in B2B vs B2C startups. This is also something we have seen at female-focused startup accelerators e.g. the last three I was invited to had over 35 companies presenting — but only three of those were B2B.

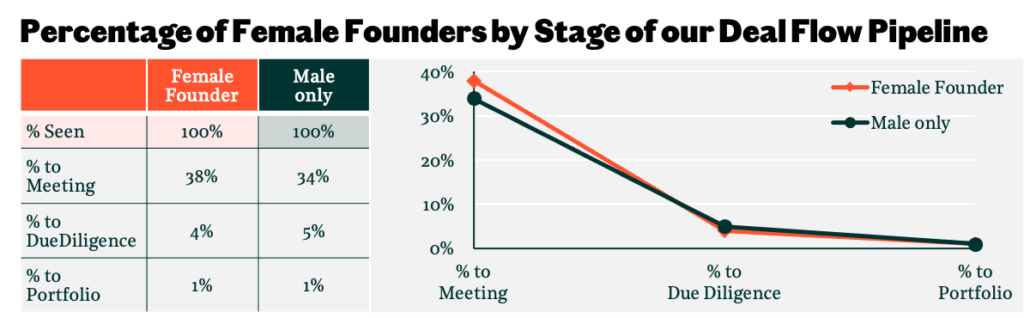

At Frontline we track how far companies get in our investment pipeline. I won’t go into all of the stages we cover, but the most important of them are:

a) Seen (ie: everything)

b) Meeting (ie: who our team decided to meet digitally or in-person)

c) Due Diligence (ie: Who we as a team, decided to research deeper into the company after a first meeting)

d) Portfolio (ie: invested).

I looked at the % of female-founded companies vs male-only founded companies that got through to each stage and it was pretty much the same regardless of gender in the founding team for all stages.

There are a few interesting points to extract from looking at the data by source of the company to Frontline. I’ve broken these into three broad areas. a) Cold Contact, b) Outbound, and c) Referred.

Cold Contact is any company that comes to Frontline that has not been referred or that we proactively targeted. This could be on email, Twitter, Linkedin, or turning up to your home (a story for another day!). I.e. they reached out to us cold. Outbound is any company that Frontline actively seeks out or does something to get in touch with (this includes direct targeting, conferences, attending accelerators, or from content and news campaigns). The final area is Referred and includes any company that comes to Frontline through an introduction.

There are a few interesting points to take from this.

- Firstly the average in Outbound is over 25% which is a testament to the Frontline team doing a number of initiatives specifically to try and increase the number of female founders in our pipeline.

- The one major anomaly is our data tracking tool in the Outbound section which seems to be almost half the average.

- It scrapes data from a number of places on the internet to highlight certain startups to us. It is only a year old and we’re constantly changing the factors it is searching for so the data may still be early in it to add much weight to it being so different yet.

- Cold contacts are substantially below average which could be either reflective of the market and/or a branding/comms issue with Frontline.

- Referred deals are roughly average at 20% but it does seem to suggest that LPs could be more proactive in sending gender diverse founders our way.

Reasons Male vs female founders are told 'no'

Last but not least, I also looked at whether there was any difference between male and female-founded companies when it came to reasons they were being passed on by our team.

We have over 20 options to mark down when our team says “no” to any specific company. There were less than a few percentage points of difference to the average on every category, so I don’t believe the difference is statistically relevant. There would seem to be no reason in Frontline that male or female founders are told ‘no’ more than the other.

Concluding thoughts on tracking gender data in VC

If we don’t measure critical data like this, we will never be able to track, change, and improve our funds and industry. I would encourage VCs to track this data for themselves. It will help all of us understand more about our funds, the biases we have, the market, and how we can improve our industry and make it more equitable to all.

When Frontline first began measuring data around gender in our deal flow process we found ourselves in the mid-single-digit percentages. Over the last five years, through a number of different methods, we’ve been able to bring those percentages to 20% — and often above 25% — on any particular month. This represents a 3–4x increase and has had a direct correlation on the % of female-founded companies we have invested in.

Please note: 20–25% is still very far from parity, and very far from where we should all strive to be. We know this and our pledge is to continue pushing, hard.

So, the next time you hear someone say the reason they haven’t invested in more female founders is because of a pipeline problem, and if they haven’t already done a huge amount to try and fix it, please point them to the data in this blog.

Whether they read this blog or not, definitely send them to Diversity VC. It is without question the best resource for ways VCs can bring more diversity to their dealflow, team and portfolio companies. Especially worth asking about the new Diversity Standard. It is an evidence-led assessment, benchmarking and certification for Diversity and Inclusion that they launched in September 2020 and are rolling out across funds globally. Frontline (And I) highly recommend it.

Frontline is always looking to work with globally ambitious and inspiring early-stage B2B entrepreneurs in Europe regardless of their gender. If you, or anyone you know, fits this description – please contact our team.

Note on Ethnicity: Gender is of course not the only area that needs to improve in our industry. Frontline does track the same data around ethnicity (where we can). We have only been doing this for 2–3 years, and it is harder to track accurately, so I thought I’d wait until we have more data before publishing this data. They are also not entirely separate topics and do overlap as well.

Note on Data: The above analysis is based on 5,525 companies that Frontline saw between 1st Jan 2016 and 31st December 2020. It is based on perceived gender by the Frontline investment team from the information we receive from entrepreneurs. We know this is not perfect, from the data we receive it makes it near impossible to differentiate different types of gender like transgender, gender-neutral, non-binary etc.