How startups should hire from the tech giants

“How can we compete with Google and Facebook for talent?”

I’ve heard this question many times from entrepreneurs. There is a perception that European startups can’t compete with the cash and equity and lunches and massages of the US multinationals stationed here.

It’s an understandable concern. And one that can be overcome.

The first thing to note — lest startups pit themselves as opponents of multinationals — is that global tech giants are net contributors to the local talent pool in the UK and Ireland. Thousands of talented immigrants are attracted here by the prospect of working for big brand tech companies. While the resulting competition for talent is stiff, it is not zero sum.

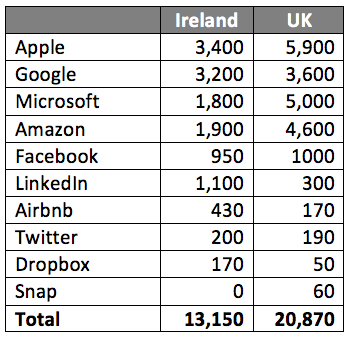

Second, the multinationals employ a lot of people here. A quick-and-dirty LinkedIn search returns the following number of employees at ten well-known US tech firms in Ireland and the UK.

LinkedIn is imperfect and these numbers are an under-estimate. But let’s proceed with them for a moment. Assuming the average annual attrition rate is 10%, about 3,400 people leave these ten companies in the UK and Ireland every year. That’s a lot of untethered talent!

Caveats apply, of course. Some of these workers are jumping to other multinationals. The majority are not the software engineers that are most in demand at startups. But the fact remains that there is substantial turnover at multinationals and, given the size of their employee base, the number of free agents churned up is high. With a little ingenuity, talented people can be prised free.

Let’s say you find someone at a multinational that you want to hire, there are a few things you should know.

What "customer segment" is your candidate in?

While compensation is only one part of this story, it is an important one. The more mature companies on the Top 10 list above pay a higher proportion of total compensation in the form of cash (salary + bonus/commission), while the younger ones rely heavily on equity. Golden handcuffs — in the form of unvested equity or deferred cash payments — are quite common, even at junior levels in US tech multinationals.

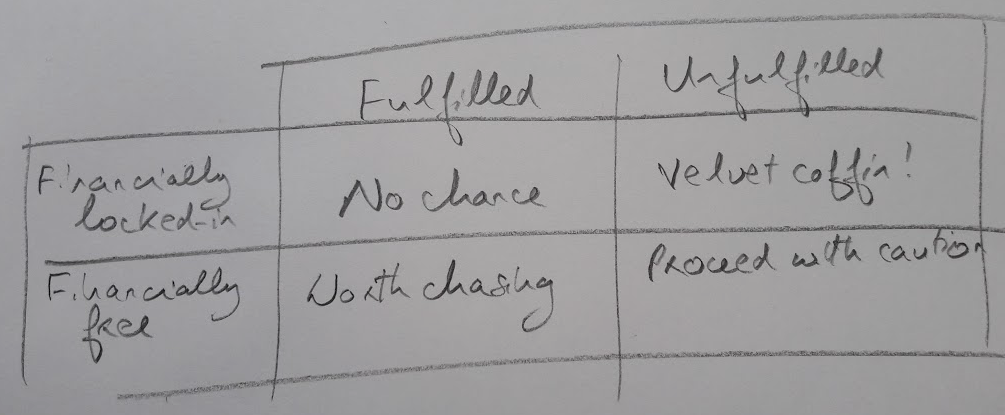

I think of financial lock-in as a state of mind rather than a number. What’s important is whether or not the candidate feels locked-in by the comp package they’re on. This is not something you can calculate on a spreadsheet. Someone who has just bought a house with a large mortgage may not be willing to take a salary cut, no matter how much they dislike their job.

Fulfilment at work is a big topic for another day. But suffice to say, it’s important to ascertain the candidate’s level of job fulfilment early in the process.

Let me say a few words about candidates in each segment.

No chance. When you encounter someone who is happy and feeling financially locked-in, wish them well and move on. This happens frequently with directly-sourced candidates — after all, a LinkedIn profile doesn’t tell you anything about a candidate’s feelings.

Velvet coffin. Members of the velvet coffin club come in two varieties: temp and perm.

- Temps. Take an unfulfilled Snap employee this week. They’d be nuts to leave six months before the lock-up period expires and their stock becomes liquid. Stay in touch with this person, but don’t bother trying to hire them today.

- Perms. Permanent members of the velvet coffin club dislike their jobs but won’t resign because the pay is too bloody good. They are typically senior and/or tenured and have a tortured mental state when it comes to their careers. They dabble in self-delusion (“I’ll leave when I find the right job”), so frequently accept recruitment calls and interview around town. Head-hunters love sending you these candidates because they look good on paper. But if you think you’ve found one, beware. They will snaffle a lot of your time and then reject your offer because the role isn’t quite right. The real explanation, though, will be money.

Worth chasing. Lots of great candidates in this category. Fulfilment at work is more often caused by good attitude than good fortune. You want people like this in your company. They make their own luck. And if they don’t feel financially locked-in — which, remember, has more to do with mindset than unvested equity — it’s game on.

Proceed with caution. Lots of great candidates in here too, but proceed with caution. Make sure you understand why they’re unfulfilled and you’re confident they don’t carry this disaffection around with them wherever they go. The best people don’t run away, they run towards.

What's your hiring product?

Personal impact beats global platform

Most people are motivated more by visible personal impact than by the chance to operate on a global platform. Startups offer the former, multinationals the latter. It is the rare job that offers both. Media coverage of entrepreneurship often focuses on the global platform — from Genentech to Facebook, companies that came out of nowhere to change the world within a decade. Your startup is likely not on that path and you don’t have to pretend it is. You can offer the kind of visible personal impact that Employee Number 50,000 at Apple will never achieve. I heard Rory O’Driscoll define your job as “something that won’t get done if you don’t do it.” By that measure, everyone at a startup has a job; the same cannot be said of everyone at a multinational. Don’t under-estimate the human desire to have a job — one that won’t get done if you don’t do it.

At some point, stop selling and wait

When an A-player candidate is torn between the safety of their public company and the risk and excitement of your startup, it is tempting to drag them over the line by any means necessary. After all, they’re so close to signing! I’ve learned the hard way that this is a mistake.

When someone chooses between two very different options, there is no right and wrong answer. It is impossible to prove that your company is the right choice. Once you have given them all the information to make a fully informed decision, it is imperative that they take the final step unaided. They must want to join you. Otherwise, they’ll always be looking over their shoulder at their old position, regretting their move when times get tough in startup land.