One of the areas of innovation we are most excited about at Frontline is the rise of application layer AI, and particularly those companies that intersect with the services industry, with categories of spend that were previously inaccessible by technology now open to disruption. The opportunity for value creation here is huge.

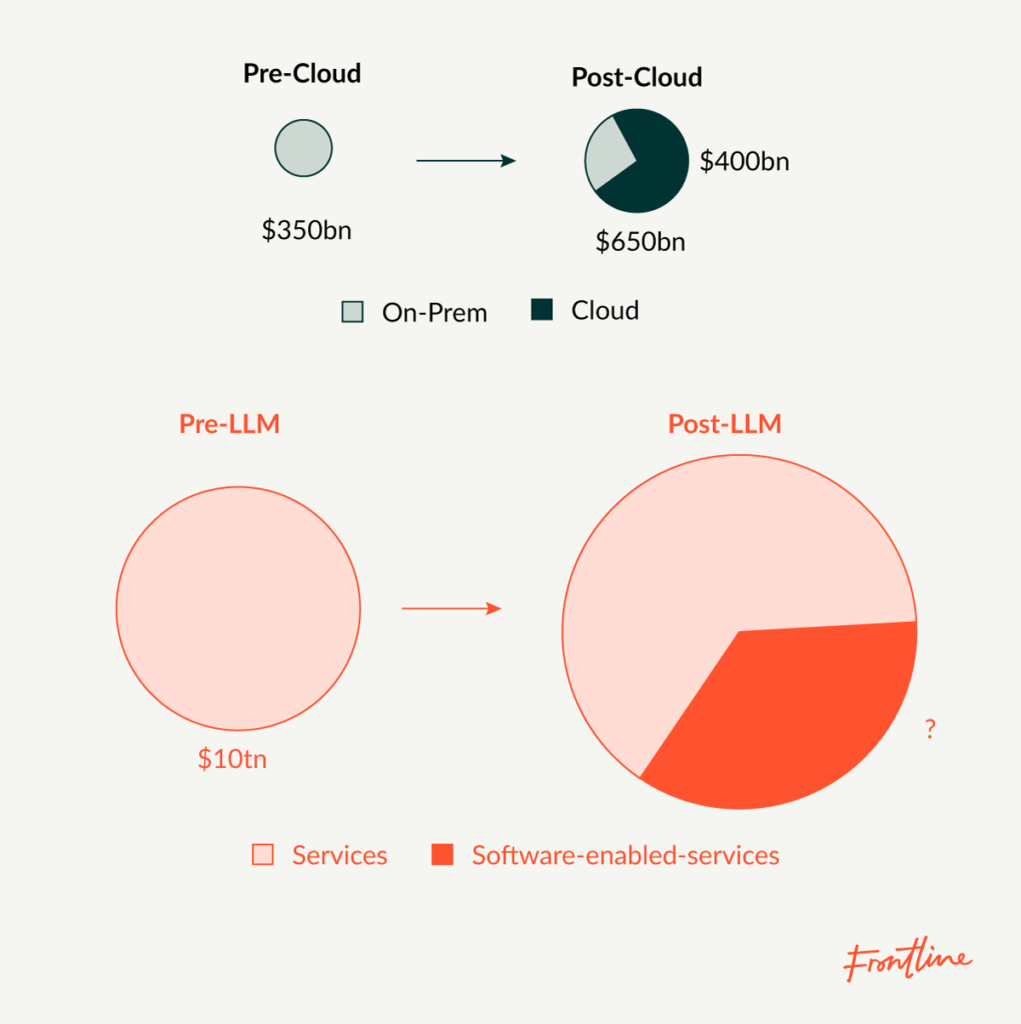

To put it into perspective, global GDP is currently about $115 trillion. Over 60% of this is generated by services, with technology contributing 5-15% of GDP across sectors. If, say, just 5-10% of services work shifts to addressable tech spend over the next decade, the total addressable market (TAM) for tech will expand dramatically.

We expect the new combined services-plus-software market to be far greater than the sum of its old parts, representing one of the next great market opportunities. We’ve seen this before, with the global switch to cloud computing from on-prem facilities expanding the total software market from $350B to $650B.

Whilst there’s broad agreement that application layer AI will redefine the tech market, the only consensus on what successful AI-first companies will look like is that they’ll be fundamentally different from the previous generation of SaaS companies.

This article—the first in a two part series—explores the five critical questions that founders must ask themselves when building application layer AI companies, in order to become global category leaders.

1. How are you handling non-determinism?

One of the defining factors of traditional software is its determinism i.e. it does exactly what you tell it to do, and it retains a traceable and auditable record of activity. AI, by contrast, is by nature non-deterministic and probabilistic, which means buyers are cautious and skeptical about adopting AI/LLM-first solutions into critical and production processes.

It will be the companies that can verifiably stand over their results with appropriate benchmarking, validation, and mitigation of bias, all in a secure way, that will be the ones to successfully navigate from experimental to production budgets.

For example, Writer—which helps businesses deploy generative AI into their processes—trains its own models, so it can disclose the training dataset and assure customers that their data won’t be used for training.

Implications for Founders:

- Demonstrate accuracy, reliability, and lack of bias—this is table-stakes, not a nice-to-have. Explainability will be particularly important in regulated industries like healthcare and finance.

- Consider approaches like confidence levels, easy-to-access citations (as seen with Perplexity), or incorporating a human-in-the-loop.

- Invest in the latest infrastructure, LLMOps, and observability tooling (e.g. Braintrust.dev, Langfuse, or others for tracing, monitoring logs, managing prompts and evaluations etc.).

2. Are you looking beyond just automation of existing workflows?

As we adopt new technology, the tendency is to take what happened in the old world and adapt it for the new platform. This is comparable to taking the on prem solution, and porting it to cloud. However, we believe the big winners won’t just optimise and automate current workflows, but will re-define how companies can achieve their objectives with new technology.

For example, rather than automating existing procurement workflows like contract generation, review, and payment, perhaps AI applications could parallelize conversations with dozens of vendors, automatically assess them, provide recommendations of the best fit vendor, before agentically completing the procurement process?

As AI or agentic products replace manual tasks, founders will have an opportunity to unbundle existing workflows and re-imagine how organisations achieve their objectives, by focussing on the customer “jobs-to-be-done”.

Take Frontline portfolio company Vanta as an example. Vanta solves the job-to-be-done of achieving and maintaining security and regulatory compliance. Rather than creating an “AI employee for compliance”, Vanta re-imagined traditional manual compliance workflows as an automated software-driven process, allowing customers to simply buy “being compliant” as an outcome.

As companies adopt agents and adapt existing workflows, new systems of records (SORs) will be needed to maintain business logic and data integrity. There is no reason to believe that the current breed of cloud-first SORs (e.g. CRMs, ERPs etc.) will survive this transition and this is where opportunity for the next generational companies lies.

Implications for Founders:

- Define the specific “jobs-to-be-done” your product solves, and focus on the “outcome” the customer can achieve rather than being tech, or workflow led.

- Set a high bar for product ambition and sophistication beyond just automation and optimisation, as category leaders are likely to become the new SORs by expanding in product surface area over time.

- Ask yourself: What can your product enable that was previously impossible? What business outcome does the customer want to buy?

3. How are you creating value above and beyond the underlying foundation models?

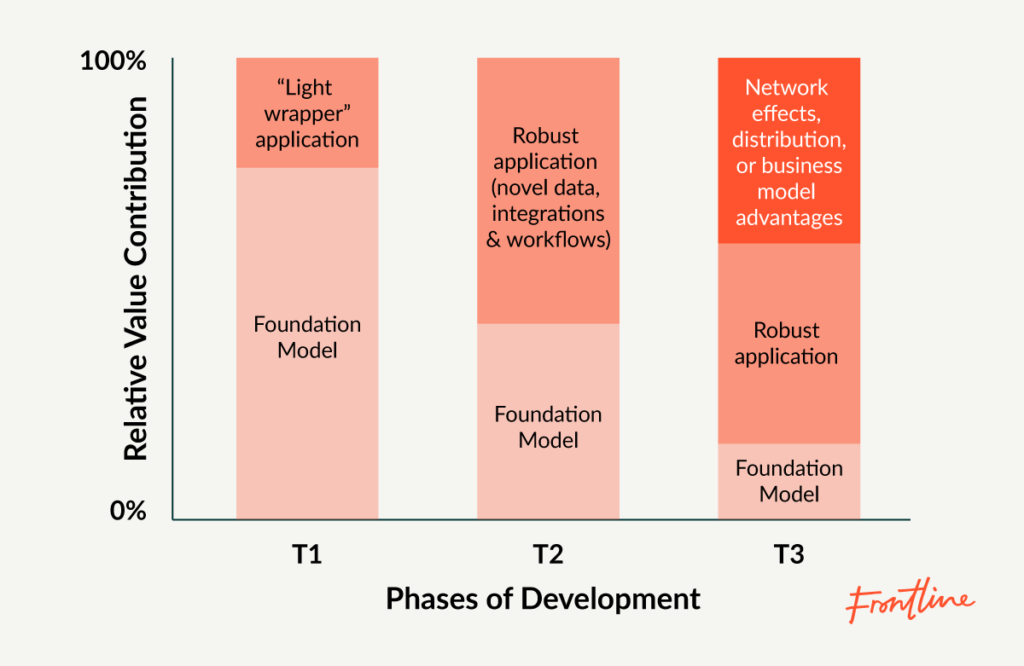

At the beginning of any platform shift, value is often derived from showcasing the power of the underlying technology, with the application layer acting as a light “wrapper”. Think back to when the first iPhone was released—many of the first popular apps were very light digitisations that showed off innovative features, like the one that made it look like you were drinking beer when you tilted the screen.

Over time, people figured out how to build truly valuable apps leveraging the power of both the underlying tech and the implications of its mass adoption. Uber would not have been possible unless you assume everyone has a device in their pocket with location tracking, payment integrations, portable interface etc. And the value that Uber creates lies in its extensive network of drivers, consumers and supporting distribution and business operations, which was bolstered by the increasing adoption and functionality of smartphones.

Similarly, the big winners in AI will be accelerated by advances in the underlying models, while having a robust and defensible value-creating layer on top. Take Cursor, the AI code editor, for example. It has a feedback loop (i.e. the code works, or doesn’t) that improves its models with usage, and the better it gets, the more developers share it with their friends to use, creating a reinforcing flywheel of adoption and quality.

Implications for Founders:

- Build applications that improve with each foundation model release and create defensible value through distribution, data, brand, and network effects. Light wrappers built on top of foundation models will not survive over time.

- Ask yourself: Does the next version of Claude or ChatGPT kill or accelerate your product?

4. Are you leveraging data, complex integrations, or regulation to create unfair advantages?

One of the obvious differentiating factors between AI-first companies will be data, particularly in regulated industries. Winning companies will likely have access to proprietary datasets, or will be combining known data sets in novel ways, or adding value in other ways on top (e.g. labelling). They will also have ways to continuously access this data either through robust integrations into Systems of Record like ERPs or CRMs, or having an “unfair advantage” by developing a clever mechanism to capture data at the source. Even better if the processing of proprietary data results in outputs in regulated spaces.

Frontline portfolio company Tucuvi, which offers conversational voice AI for healthcare organisations, is a great example of this. Its models, trained on millions of hours of clinical conversations, are both proprietary and clinically validated, giving it a significant competitive edge.

Implications for Founders:

- Push for access to proprietary, hard-to-replicate, or unusually large training sets.

- Explore integrations and mechanisms to collect and surface data in useful formats (LLM readable), or with genuine IP in your data model.

- Leverage regulation to your advantage if possible as a source of moat.

5. Are you considering the appropriate interface and modality?

As technology evolves through incremental platform shifts, so do the ways we interact with it. This is not a new story. The graphical user interface (GUI) was a step change in interactivity with technology, democratising access for people to control applications via simple points, clicks, drags and drops rather than requiring knowledge of command lines. The pace of change of natural language understanding and response in AI will similarly alter how, where and when we interact with software. The use of voice, and natural language prompts are likely to play an increasingly important role.

However, founders also have a new dimension to consider for their products which is how much they want to push to “agents” vs for what they will keep human interaction in the loop. This is a new vector of competitive differentiation. For example, frameworks like Llamaindex or Langchain approach is to give developers full control via code in the building of AI apps and agents. Whereas other companies are opting for no-code or low-code interfaces for building agents (e.g. n8n, or Langflow). Great founders will meet their ideal customer profile (ICP) where they are, and effectively distinguish which tasks make sense to run in the background agentically, and which require human interface and control.

Implications for Founders:

- Offer optionality of interface or have a strong rationale for focusing on a specific modality.

- Old style GUIs won’t be dead, but you should stay aware of how shifting market dynamics influence user expectations, and be intentional about your choice of interface and modality.

- Be opinionated on which tasks require human interaction points, vs which make sense to run agentically with less human control.

So, are you a killer team creating an application-layer product with solid answers to each of these questions? At Frontline, we are always looking to partner with the most ambitious founders as early as possible.

Feel free to get in touch at [email protected], and check out the next article in this series, here.